If you’re debating whether to rent or buy a home in Ventura County, the decision isn’t always straightforward. Your financial situation, long-term goals, and lifestyle needs all play a role in determining which option is best.

Some people enjoy the flexibility of renting, while others prefer the stability and wealth-building potential of homeownership. Let’s break down the key factors to consider so you can make an informed decision.

The Benefits & Downsides of Renting

Renting is often the easiest option for those who aren’t ready to commit to a long-term home. It requires lower upfront costs and gives you the flexibility to move when needed.

✔ Pros of Renting:

- Lower upfront costs – No need for a large down payment.

- Easier to relocate – Ideal if you expect to move within a few years.

- Minimal maintenance responsibilities – Your landlord takes care of repairs.

However, renting has its downsides—you’re paying for a place to live, but you don’t gain any ownership benefits.

✖ Cons of Renting:

- No equity – Your rent payments don’t build wealth.

- Rent increases – Landlords can raise rent over time.

- Limited control – You can’t renovate or customize your living space.

If you plan to stay in Ventura, Oxnard, Camarillo, or Simi Valley for only a short period, renting may be the best choice. But if you’re ready to settle down, buying could be a smarter move.

👉 Related: First-Time Home Buyer Mistakes to Avoid

The Benefits & Downsides of Buying

Buying a home is a long-term investment that offers financial stability, potential appreciation, and the ability to build equity.

✔ Pros of Buying:

- Wealth-building – Your mortgage payments contribute to ownership, not a landlord’s pocket.

- Stable housing costs – Fixed-rate mortgages provide predictable payments.

- Creative freedom – Customize your home as you like.

However, homeownership comes with more responsibility and higher upfront costs.

✖ Cons of Buying:

- Upfront costs – A down payment, closing costs, and maintenance add up.

- Market risks – Home values can fluctuate over time.

- Less flexibility – Selling a home takes time and may not be ideal if you move frequently.

If you’re planning to stay in Ventura County for 5+ years, buying can be a better long-term decision since you’re investing in an asset that grows in value over time.

👉 Related: The Hidden Costs of Buying a Home

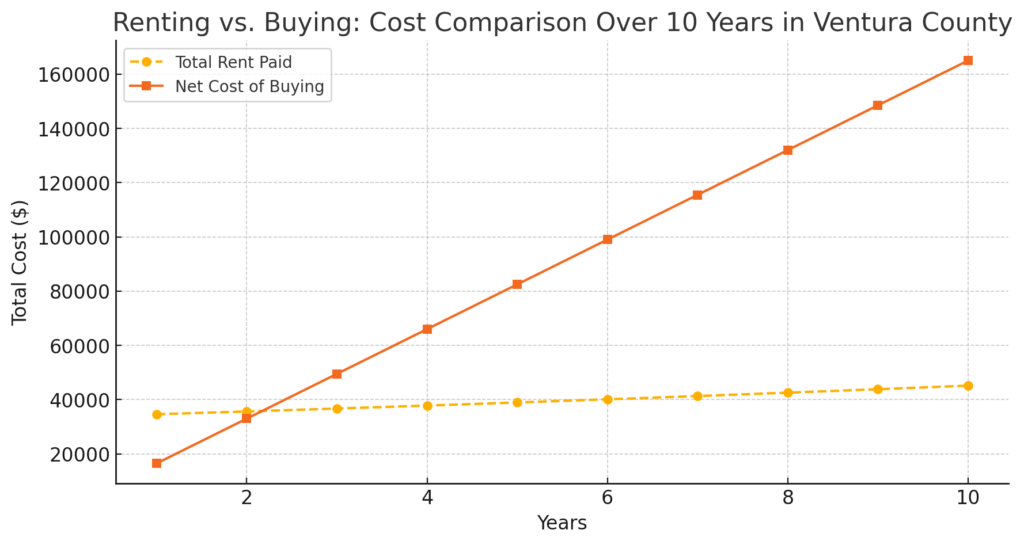

Renting vs. Buying: Cost Comparison Over Time

In the short term, renting is typically cheaper because you avoid a large down payment and maintenance costs. However, over the long term, buying a home is financially beneficial because you’re building equity and locking in stable monthly payments.

I’ll generate a cost comparison graph to visualize how the financial gap between renting and buying grows over time.

Renting vs. Buying: Cost Comparison Over 10 Years in Ventura County

The graph above compares the total cost of renting vs. buying a home over 10 years in Ventura County.

- Renting: Starts with lower costs but increases over time due to annual rent hikes. After 10 years, renters will have spent a significant amount without building any equity.

- Buying: Requires a higher upfront investment (down payment and mortgage), but as home values appreciate and mortgage payments contribute to equity, the net cost of ownership becomes lower than renting.

This visualization highlights how homeownership becomes more financially beneficial over time, allowing you to build wealth rather than just cover living expenses. If you plan to stay in Ventura County long-term, buying a home can be a strategic financial move.

Key Questions to Help You Decide

1. How Long Do You Plan to Stay?

- Short-term (1-2 years): Renting offers flexibility.

- Long-term (5+ years): Buying helps you build wealth.

2. Can You Afford the Upfront Costs of Buying?

- Many buyers think they need 20% down, but FHA loans allow as little as 3.5% down, and VA loans require 0% down for eligible buyers.

- Renting has lower upfront costs, but buying provides long-term savings.

👉 Related: Down Payment Myths That Keep Buyers on the Sidelines

3. Do You Want to Build Wealth?

- Buying a home builds equity, increasing your net worth over time.

- Rent payments only benefit the landlord, not you.

4. Are You Ready for Homeownership Responsibilities?

- As a homeowner, you’ll need to budget for maintenance, property taxes, and insurance.

- Renters avoid these costs, but lack stability and control over their living space.

Let’s Walk Through the Home Buying Process Together

Buying a home in 2025? Don’t go in blind! If you’re unsure about where to start, schedule a free home buyer consultation with me. I’ll walk you through everything you need to know—from financing options to market trends—so you feel confident in your next steps.

Schedule your free home buyer consultation today—let’s get you one step closer to homeownership!

📞 Call/Text: 805.823.2370

📧 Email: [email protected]