Navigating the real estate market can be challenging, but understanding when to buy or sell is key to maximizing your investment. In this post, I’ll share my insights—backed by local market data from several Ventura County cities—to help you determine the best time to make a move. Whether you’re a buyer or a seller, timing matters, and here’s why.

Why Timing the Market Matters

Many homeowners and buyers wait for the “perfect moment” when prices or rates drop, sometimes holding out for years. However, waiting too long can cost you—in rent payments that build no equity or in higher home prices over time. The simple truth is: the best time to buy is when you’re ready and when it makes sense for you and your family.

As a local real estate professional, I work with clients every day and have seen firsthand how waiting out of fear or uncertainty can mean missing out on building long-term equity. Instead, focus on your personal readiness and financial capacity, and let the market’s natural progression work for you.

City-by-City Market Breakdown

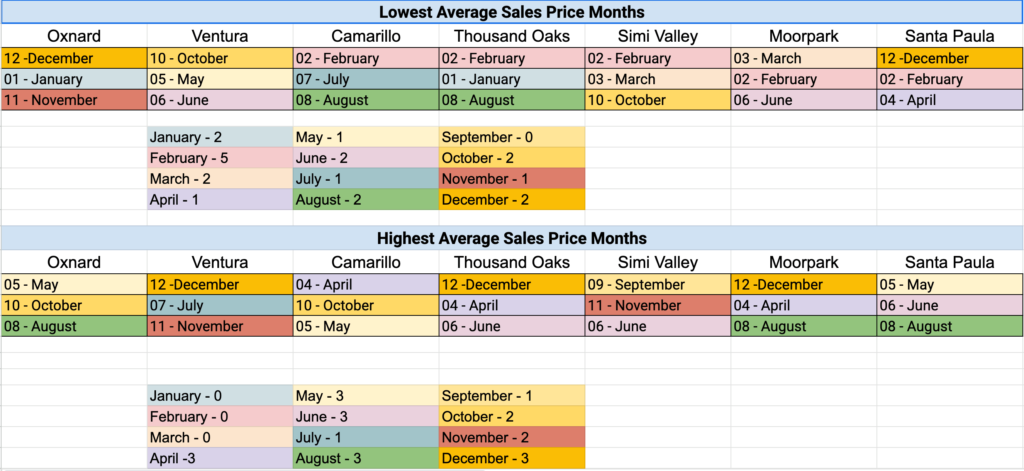

I’ve analyzed the average sales price trends across seven key cities in Ventura County. Here’s a snapshot of what the data shows:

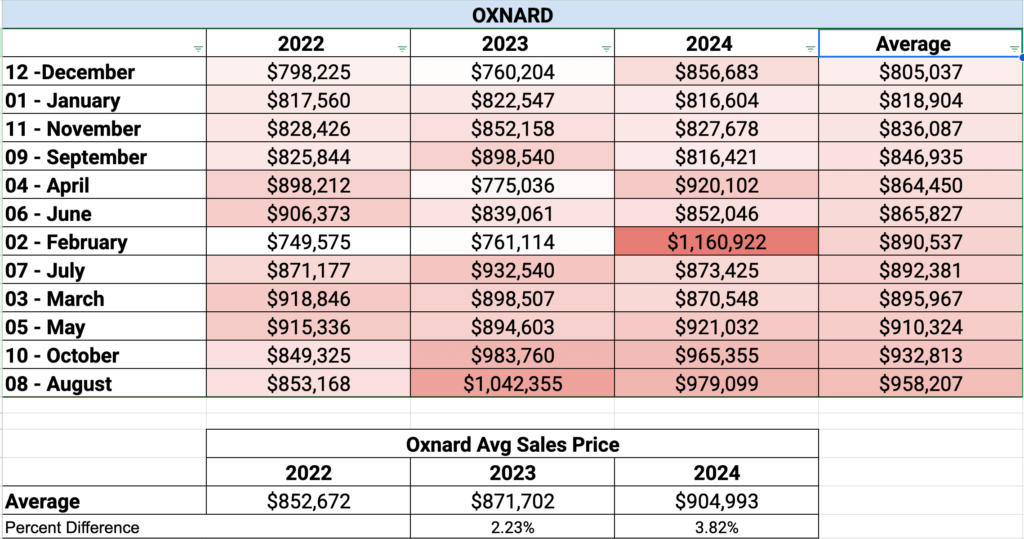

Oxnard

- For Buyers: The data indicates that December, January, and November tend to offer the best deals. These months typically have lower average sales prices, making it an ideal time for buyers looking to maximize their purchasing power.

- For Sellers: If you’re selling, consider listing your property in October or August. During these months, homes tend to command higher average sales prices.

- Market Trend: Recent comparisons show a steady increase in average sales prices year-over-year. For example, between 2022 and 2023, prices rose by about 2.23%, and the trend continued into the next year.

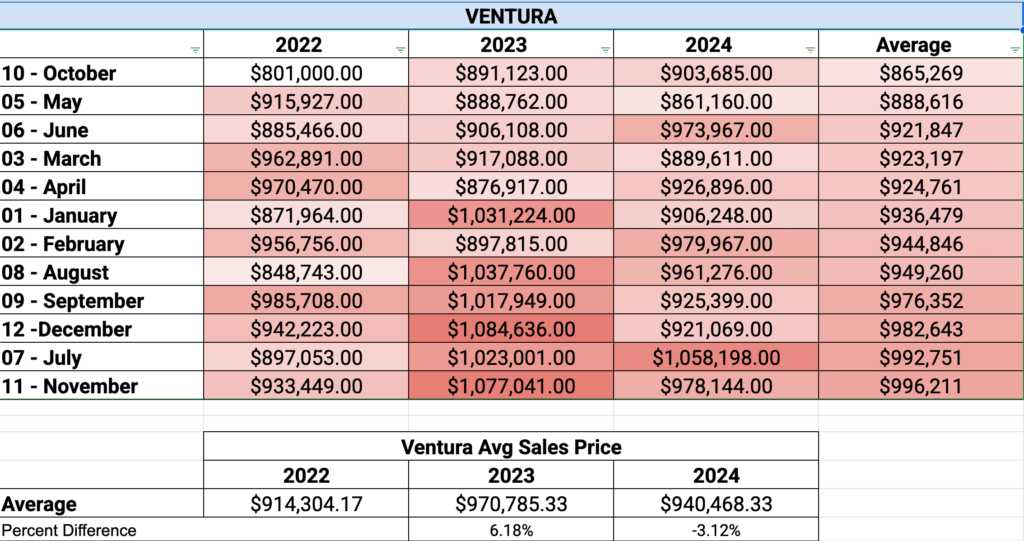

Ventura

- For Buyers: In Ventura, October, May, and June often present the best buying opportunities. Interestingly, although one might expect summer months to offer more competitive pricing, local trends show a different pattern.

- For Sellers: The market here shows that November, July, and December tend to fetch higher prices, making them the best months for sellers.

- Market Insight: Despite some fluctuations, Ventura’s market displays a clear seasonal progression, with end-of-year periods generally being more expensive.

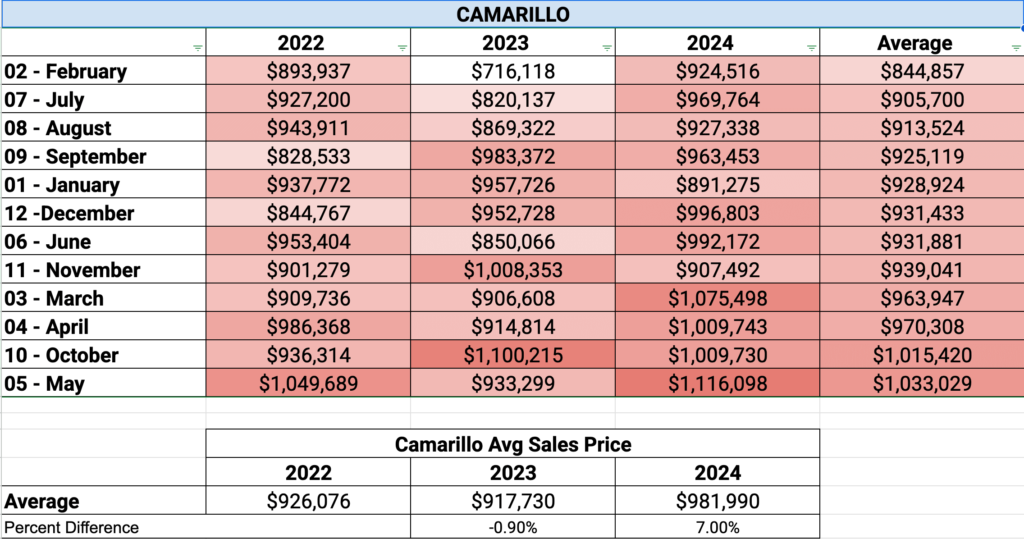

Camarillo

- For Buyers: Camarillo’s most affordable months are February, July, and August—demonstrating that even summer months can sometimes be buyer-friendly.

- For Sellers: If you’re planning to sell, the data suggests that April, October, and May are the most advantageous times, offering higher average sale prices.

- Trend Analysis: While there was a slight dip in average prices in 2023, the upward trend resumed in 2024, indicating a recovering and strengthening market.

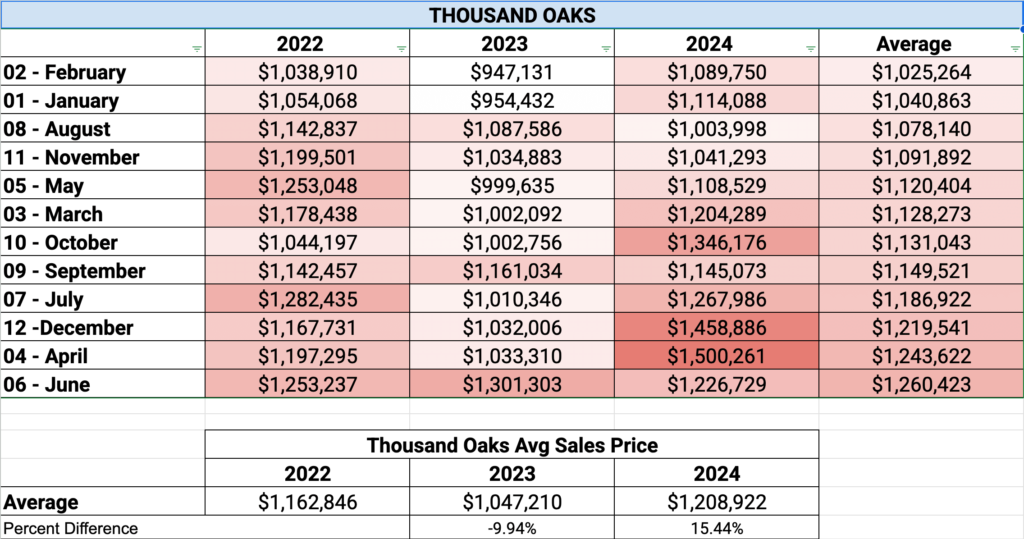

Thousand Oaks

- For Buyers: The best deals in Thousand Oaks tend to be available early in the year, with January and February leading the way. August also appears as a favorable month.

- For Sellers: December, April, and June have shown higher average sales prices, though the data here is more scattered throughout the year.

- Recent Movement: There was a noticeable drop in prices from 2022 to 2023, but a robust rebound in 2024 now makes properties more expensive than they were in 2022.

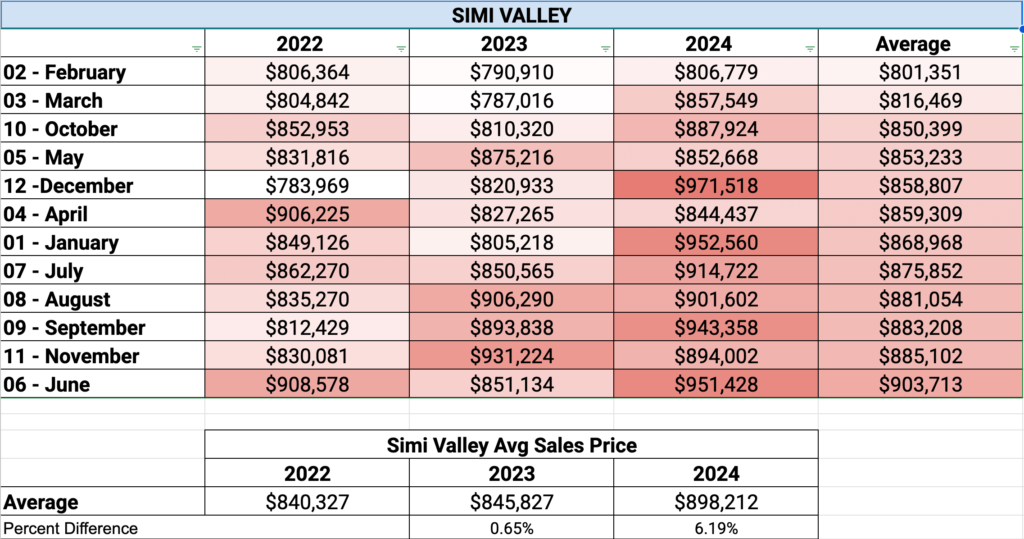

Simi Valley

- For Buyers: Buyers in this area should look towards February, March, and October for the best deals.

- For Sellers: September, November, and June emerge as the most lucrative months for selling.

- Market Dynamics: While there’s some seasonal variability, the overall trend shows modest increases year-over-year.

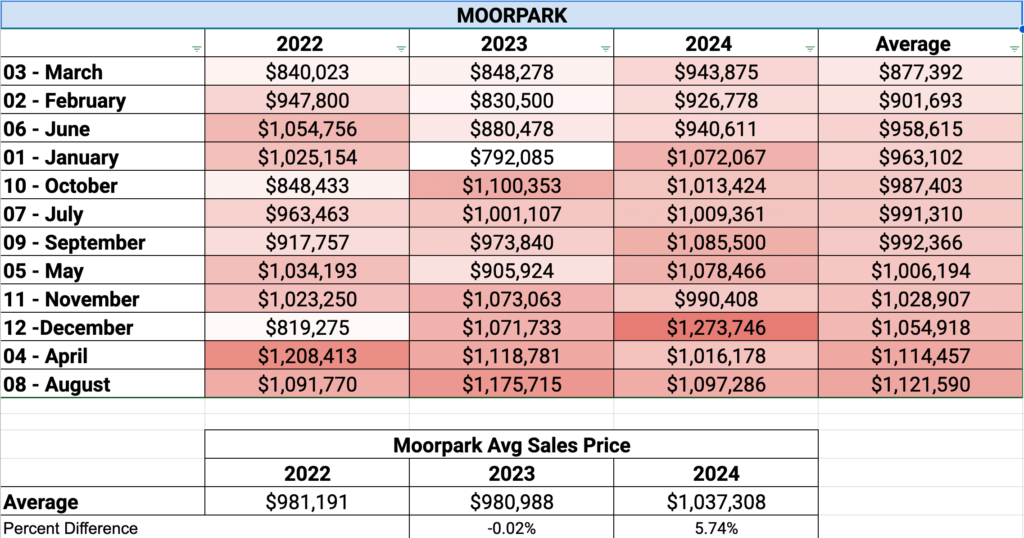

Moorpark

- For Buyers: Moorpark’s most affordable months are March, February, and June, offering buyers a chance to snag a good deal.

- For Sellers: If you’re selling, December, April, and August tend to yield higher sales prices.

- Trend Note: The market here has seen a mix of slight dips and subsequent recoveries, reflecting the broader trends in the region.

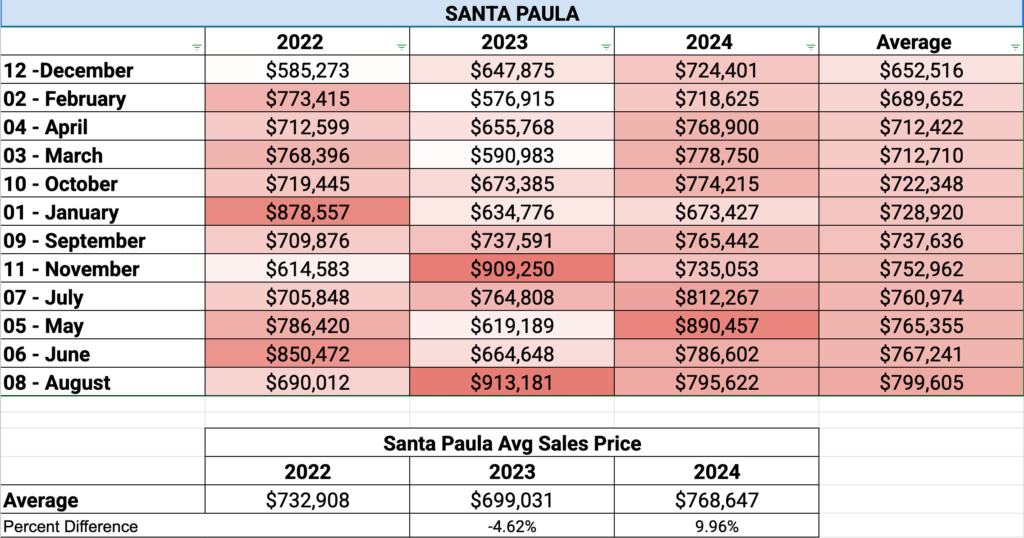

Santa Paula

- For Buyers: December, February, and April are the prime months for buyers in Santa Paula, when home prices are typically lower.

- For Sellers: The best time to sell appears to be in May, June, and August, when average sales prices peak.

- Overall Trend: Although there was a dip from 2022 to 2023, Santa Paula has bounced back, with 2024 figures remaining significantly higher than earlier years.

A Quick Comparison

Looking across these cities, one interesting pattern emerges:

- Lower Average Sales Prices: February tends to be a standout month for more affordable home prices in many cities.

- Higher Average Sales Prices: April, August, and December are generally when homes are priced at a premium.

Keep in mind that each city has its own nuances. For example, while August is expensive in Oxnard, it is one of the most affordable months in Camarillo and Thousand Oaks. These differences highlight the importance of localized market data when planning your real estate moves.

The Cost of Waiting: Renting vs. Buying

It’s easy to underestimate how much waiting can cost you. Consider this simple rent calculator:

- Renting at $2,500/Month: Over two years, you could spend around $60,000, and in five years, that climbs to $150,000.

- Higher Rent Scenarios: At $3,000 a month, you’d spend $72,000 in two years and $180,000 over five years.

- High-End Rents: For those paying $3,500 per month, waiting five years might cost you as much as $210,000 in rent—money that could instead build equity in your home.

These figures underscore that renting is essentially paying 100% interest—money that doesn’t contribute to your long-term financial growth. If you have the capacity to buy, investing in a home sooner rather than later can be a smart financial move.

Final Thoughts: Act When the Time Is Right

While market data provides a helpful guide, the best decision is always based on your personal situation. If you’re in a position to buy, the current market may be more affordable than you think. And if selling is on your mind, listing your property during peak months can help you maximize your returns.

Remember, waiting can have a significant price tag—not only in terms of home prices but also in the opportunity cost of rent that doesn’t build equity. My professional advice? Don’t wait if you’re ready. Reach out for a free consultation, and let’s work together to craft a strategy tailored to your goals.

Let’s Walk Through the Home Buying Process Together

Buying a home in 2025? Don’t go in blind! If you’re unsure about where to start, schedule a free home buyer consultation with me. I’ll walk you through everything you need to know—from financing options to market trends—so you feel confident in your next steps.

Schedule your free home buyer consultation today—let’s get you one step closer to homeownership!

📞 Call/Text: 805.823.2370

📧 Email: [email protected]